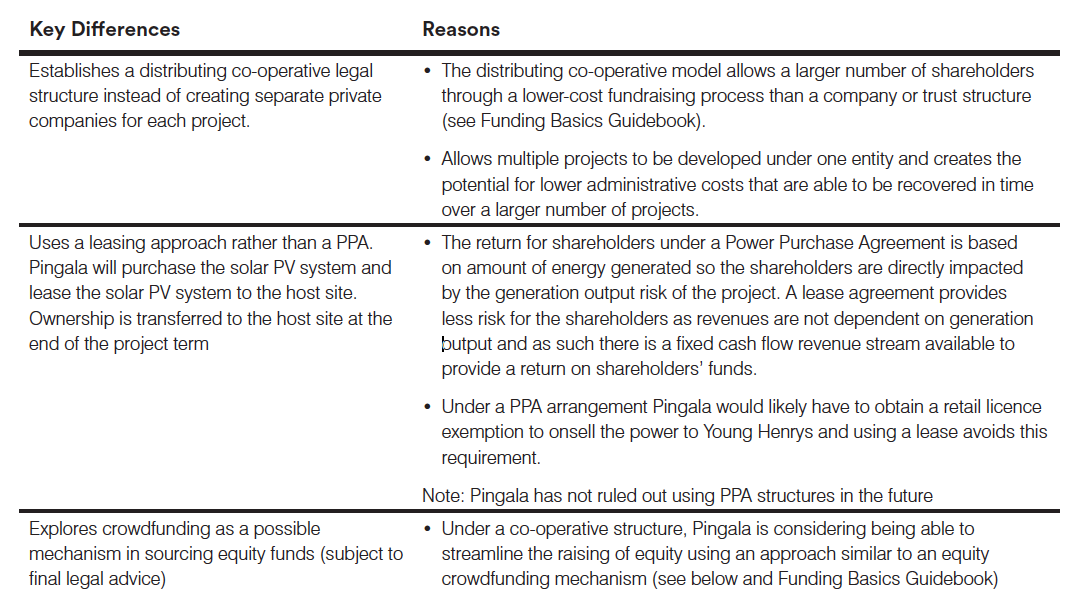

The Sydney-based Pingala group has adapted the Repower Shoalhaven model to create a new model that uses a co-operative structure to develop projects (rather than private companies) and generates its revenues by leasing the solar installation to the host site.

In summary the Pingala group modified the Repower Shoalhaven model for the Young Henrys project in the following ways for the reasons outlined:

Brief History of Pingala

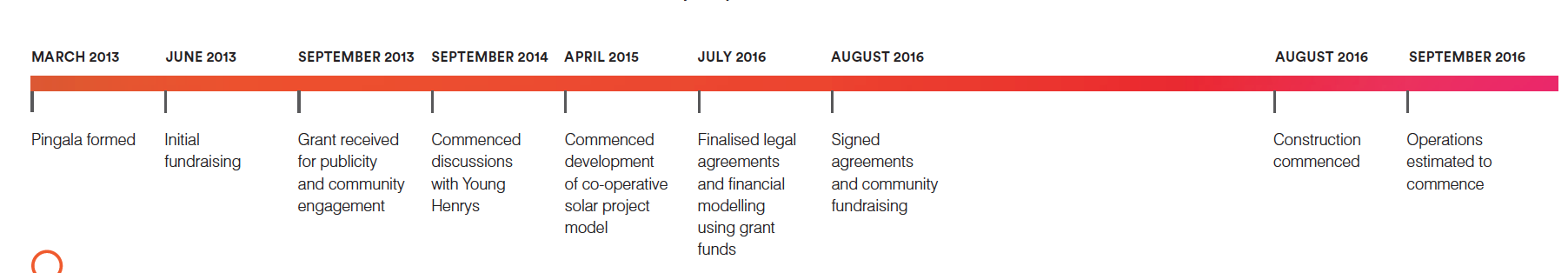

On 13 March 2013, a community forum was held at the Redfern Town Hall, which was organised by Pingala’s founder and current convenor, April Crawford-Smith. Attendees at that event were invited to a workshop facilitated by the Community Power Agency on 17 March 2013 at Redfern Oval. Out of the workshop Pingala was born, with 20 attendees making the commitment to form a new community energy group in Sydney.

Pingala has a vision for a fairer energy system and this drive for equality and fairness has influenced choices when determining the funding model and business structures to use for their CE projects. A key value proposition for members of the Pingala Co-operative is the ability to support local businesses who are doing the right thing for the environment and their community.

Pingala plans to develop CE solar farms on the roofs of businesses and this is being done in a way that connects the business with their vision by inviting them to become investors in the solar infrastructure. A key value proposition for host sites is the ability to create a set of community energy champions who are invested in the future success of their business.

The timeline below sets out key steps in the evolution of Pingala and the Young Henrys Project:

Funding Model Overview

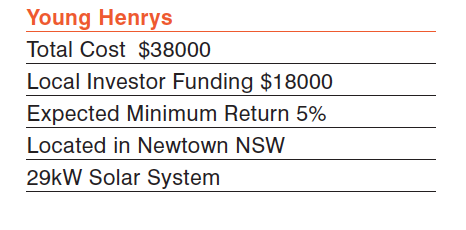

The current project has delivered a 29kW solar PV system installed on the roof of Young Henrys brewery in Newtown. The Pingala Co-operative is leasing the installation to the brewery operator. Under the lease agreement co-operative members will effectively receive lease payments that are not dependent on the solar generation output resulting in a fixed cash flow revenue stream to provide a return on shareholder’s funds. At the end of the term of the lease the ownership of the solar system will be transferred to Young Henrys.

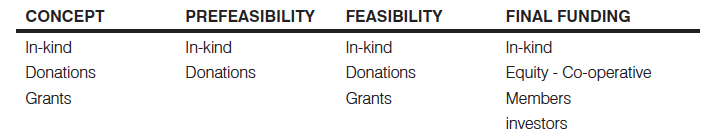

Pingala’s initial funding was derived primarily from two grants from the City of Sydney. The first grant was used to promote Pingala and build their base of supporters. The second grant was principally provided to assist with costs associated with the development of legal and financial advice and templates and also included some funds ($20,000) to contribute to project development costs for the Young Henrys project. It is important to note that the grant funding was not required to make the project commercially viable but the grant has made it much easier for Pingala to establish their overall development framework more quickly than they could have hoped to. The contribution of grant funds to the Young Henrys project will help to reduce the risks for the investors in Pingala’s first project and will be used to assist in the development of future projects.

The actual Solar PV project (approximately $40,000) is funded roughly 50% by grant funds and 50% via equity from community shareholders in the Pingala Co-operative.

Funding Model Evolution

Pingala is has developed a funding model based on equity investment from co-operative members. This model is an adaptation of the models used by Repower Shoalhaven and ClearSky Investments which are utilising Special Purpose Vehicles established as Private Companies or Trusts respectively.

Pingala has replaced the per-project SPV (the Pty Ltd Company or the Trust) with a multi-project investment entity (incorporated as a Distributing Co-operative). The Pingala model enables an unlimited number of community investors to invest in multiple projects. This is not possible for company and trust structures wishing to keep their fundraising costs down using the 20/12 exemption rule (see Funding Basics Guidebook).

Key lessons and tips

- Form follows function. Choose a legal form that best serves your needs as an organisation. Pingala chose a legal structure that enabled a large number of investors to participate and multiple projects to be replicated at an expected lower cost of administration

- Don’t duplicate. Learn from the best CE models already available. Use their learnings and resources and adapt them.

- Invest in a campaign to attract supporters. To be successful it is important to gain supporters. Pingala was able to achieve this through a publicity campaign that was funded by City of Sydney.

- Converting community support into momentum. Pingala was able to move quickly to leverage the public support following its first event at the town hall by quickly organising a follow up event with an independent workshop facilitator to build a shared vision and a coherent plan for Pingala’s first steps.

- Discuss grant applications with grant providers prior to submission. Pingala’s original intent was to secure a larger funding commitment from City of Sydney. They learnt through discussions with the City of Sydney grant manager that the application amount and scope needed to be modified to ensure the application was successful.

Types and Sources of Funding

The types and sources of funding used for the project through each of the project development phases are summarised in the table below:

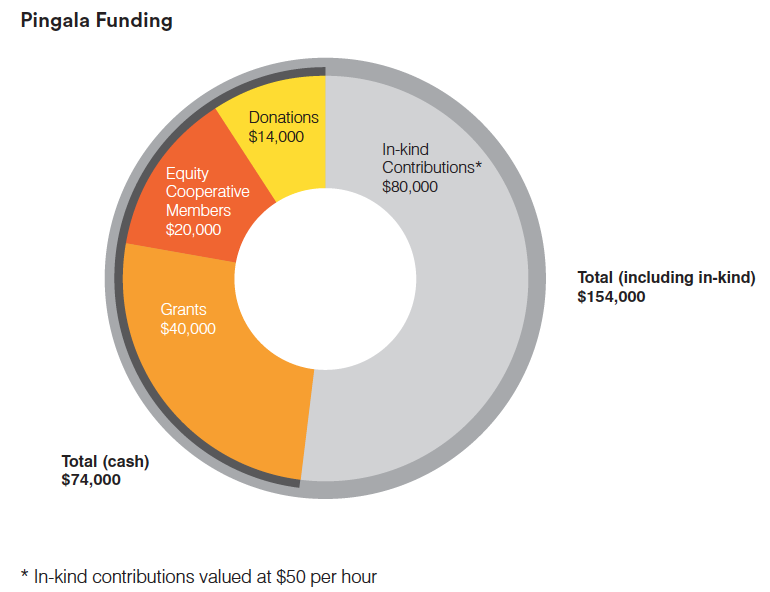

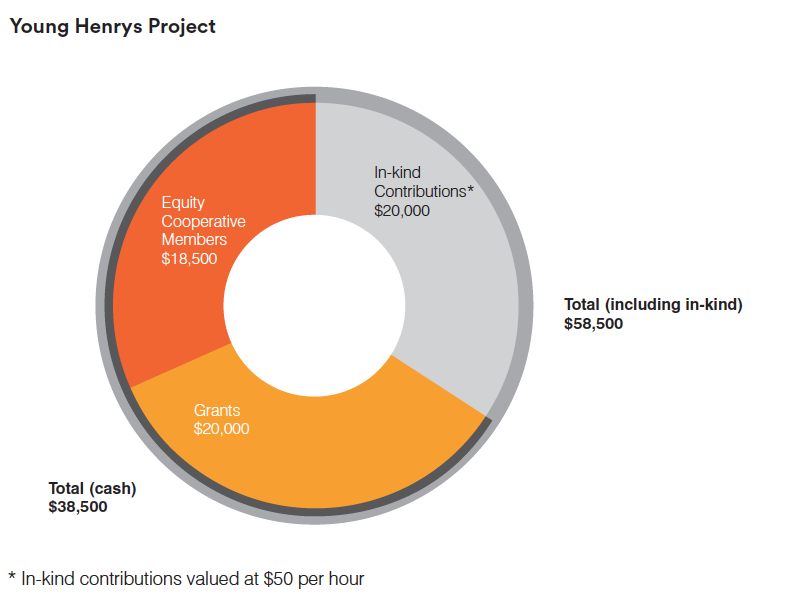

The amount of funding generated by Pingala for the Young Henrys project is shown in the two charts. The first chart shows Pingala’s total funding while the second one shows the funding related specifically for Young Henrys:

The actual construction and setup cost of Young Henrys just under $40,000 and is co-funded from co-operative members’ equity and grant funds. Other costs have been funded primarily in-kind with support through the grants and donations received by Pingala. The grants are primarily associated with project development and include legal advice/templates and financial advice/ templates which can be used in future projects, making development of later projects much cheaper.

Funding Contribution Breakdown

In-kind

Pingala has relied on considerable local volunteer contributions as well as the goodwill of other CE groups to develop its business model to an advanced state. Pingala’s founders were able to establish a core group of committed volunteers through an initial meeting and workshop. The group is known as the Action Team and the 20 people involved have remained relatively unchanged during the three years the project has been running.

Leadership by a few core individuals has been critical for the successful progress of the project. Pingala’s convenor, April Crawford-Smith, and project secretary, Tom Nockolds have devoted considerable time to the project. There is a second tier of dedicated and passionate volunteers, who bring commitment and essential skills to the project.

Key lessons and tips

- Establish shared commitment. Developing a project using volunteer efforts may take considerable time. A team which has built a

- shared culture of trust and commitment will be able to operate for the long duration required without falling apart or losing interest.

- Accept contributions from all volunteers. Some individuals have key skills but have little time and others have plenty of time on their

- hands, but are perhaps lacking the skills required. Ensuring that everyone’s contributions is valued is an important part of a

- successful collective volunteer organisation which has longevity.

- Speak to other CE groups. Pingala learnt from other CE models. CE organisations are generally community orientated and willing to

- share information and support other CE project developments.

Grants and donations

Pingala has received two grants from the City of Sydney that assisted in the success of the project to date.

Initially Pingala had hoped for a large grant to develop their business model and ended up changing their plans as the City of Sydney advised them to scale down their application to the critical first step which involved a publicity campaign to promote Pingala. As a result Pingala was awarded $10,000. This was a good suggestion as it meant Pingala focused initially on developing a strong publicity campaign which proved critical in building a strong supporter base for the organisation. As a result, Pingala now claims to be one of the most strongly-supported community energy organisations in Australia with its large membership and newsletter readership, strong social media following and a large group of volunteers.

The second grant, was for $44,000 and was used for the development of legal and financial templates as well as providing funds for the first project which will also benefit future projects

Key lessons and tips

- Be flexible and adaptable. There’s no point submitting a grant application that will not be successful. It is important to develop relationships with grant funders and listen to their advice.

- Role of grants – They can be useful for the development of new business models but cannot be relied upon, as they are often not available. CE projects should rely on equity, in-kind support and donations to be successful.

Access to legal and financial templates - CE developers can access financial templates that have been developed by Pingala which will financial templates that have been developed by Pingala which will.

Equity funding

The Pingala equity funding model is similar to a crowdfunding model as follows:

-

Members of the public will be invited to become members in the Pingala Co-operative by purchasing shares to fund the Young Henrys project. The minimum shareholding will be set as low as possible, balancing the requirements for low entry costs and the ongoing annual costs to manage each shareholder. While a disclosure document is required (setting out certain information about the shares being offered) the requirements are well below the threshold which applies for prospectuses in a traditional equity raising.

- It is currently proposed to set the minimum shareholding at $500 as Pingala wishes to engage a large number of investors from within the community even if this has an impact on the administration costs. The ability to fund the administration costs for handling a larger number of investors still needs to be tested. The co-operative will target an annual return to members of between 6% and 8%, which can be in the form of a dividend, rebate or bonus shares.

- The equity offered will be in the ongoing Pingala Co-operative which proposes to develop a series of further projects after Young Henrys under the single co-operative banner.

Crowdfunding

Pingala has been considering plans to host its own crowdfunding website. The NSW Co-operatives National Law regime is such that it allows for public offers of equity in the co-operative with minimal disclosure requirements provided that offers are made to members and are restricted to persons within NSW. Co-operatives laws in other states or territories may not currently permit this same approach, but this is changing as states adopt the Co-operatives National Law framework; this may open up greater opportunities for this mechanism in the CE sector (see Funding Basics Guidebook).

Key lessons and tips

- Project versus enterprise. The model is supporting membership of the Pingala Co-operative entity rather than individual projects. This is important to the Co-operative as the members see this as a longer term investment in line with the overall goals of the organisation rather than a short term returns from specific projects. Funds from individual projects are reinvested into future projects.

- Equity crowdfunding for co-operatives may be allowed. This may provide a mechanism to very cost effectively raise equity from a large number of investors.

Business Structure

Pingala is utilising a distributing co-operative as the project entity. This is a multi-project investment entity that is owned by its member-shareholders.

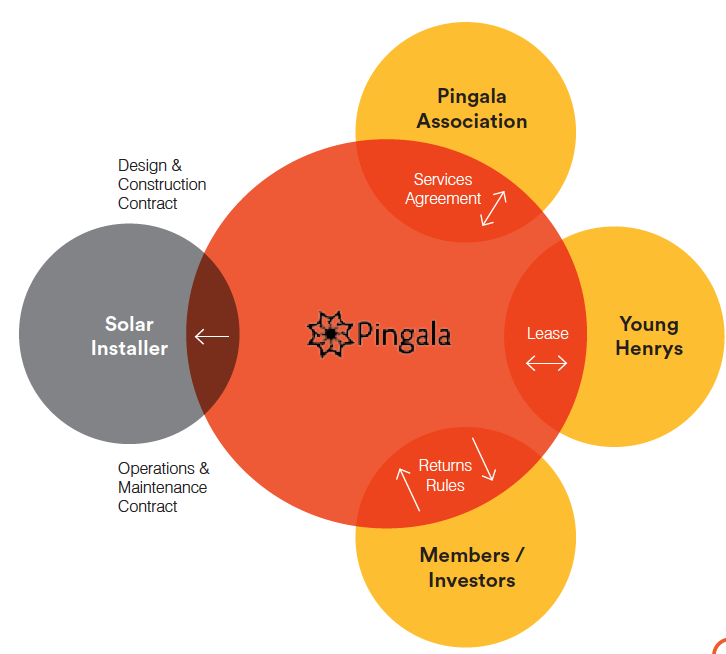

The Pingala Co-operative is a completely independent organisation from the original Pingala Association. This arrangement requires a detailed services agreement between the two organisations. The structure is shown diagrammatically below:

- The co-operative structure being used by Pingala is in many ways similar to a corporate structure but provides some advantages in relation to regulation and costs. As a co-operative Pingala needs to maintain member involvement and expand membership to allow it to achieve its overall community involvement and funding objectives.

- When a new project is to be financed by the co-operative, shares will be issued as required to fund the project. These funds will be used to purchase solar equipment which will remain the property of the co-operative for the duration of the project.

- Income is derived from the customer (Young Henrys in the first instance) through a lease agreement which operates over a defined period and allows the customer to use the solar equipment in return for a recurring lease fee. This income is then used to provide a return to the member-shareholders as well as to pay the co-operative’s various operating expenses.

- The major operating expenses for the project will be the annual financial services (book-keeping and accounting) and management services paid to the Pingala Association. The Association is responsible for the day-to-day running of the co-operative with duties such as shareholder management, reporting, etc. When the solar panels have been paid back, ownership is transferred to the customer for a nominal fee.

- The model is designed so that the Pingala Co-operative can operate many projects at once and it is anticipated that the cost of operating the co-operative with multiple projects will be lower than the cost of operating multiple SPVs. The lower costs are important given there are low margins in the development of solar PV projects.

Share capital in a co-operative has certain attributes that Pingala has accommodated in the final the final implementation of their model:

- Firstly, if a shareholder ceases to be a member, then the co-operative will repay the member an amount for the share capital provided in accordance with section 128 of Co-operatives National Law

- Secondly, Co-operatives National Law restricts returns to shareholders to a ‘Limited Dividend’ with the rate of permitted return being defined in the regulations.

Pingala is navigating these regulatory challenges with the assistance of their legal and financial advisors who were paid in-part with funding provided by the City of Sydney Environmental Innovation Grant. Pingala managed to find advisors who were already knowledgeable on issues associated with community energy and the broader energy market in Australia and this has assisted in reducing time and effort in project development. Now that Pingala has established their initial capital raising they intend to publish a number of documents in relation to their approach with respect to legal, financial and operational aspects of the co-operative and the Young Henrys project. Developers should seek legal advice when considering co-operative structures for their projects as there are a number of legal nuances associated with the operation of a co-operative and in seeking funding through members of the co-operative.

Key lessons and tips

- Find advisors with the right experience and knowledge. Make sure you reference check advisors and ensure that they have relevant experience in the CE sector

- A multi-project entity has its own benefits when compared with an SPV. An SPV can provide very low setup and administration costs for a single project. However, using a co-operative structure as a multi-project entity may be cheaper once there are many projects in operation.

- Leasing reduces performance risk to investors. The investors are paid a fixed amount from the lease arrangement regardless of how much energy is generated.

- A co-operative structure allows for many investors. A co-operative is not subject to limitations on investors such as those under the 20/12 exemption rule and Pingala is aiming towards having hundreds or possibly thousands of investors in its future portfolio of projects.

Project Element Development and Management Approaches

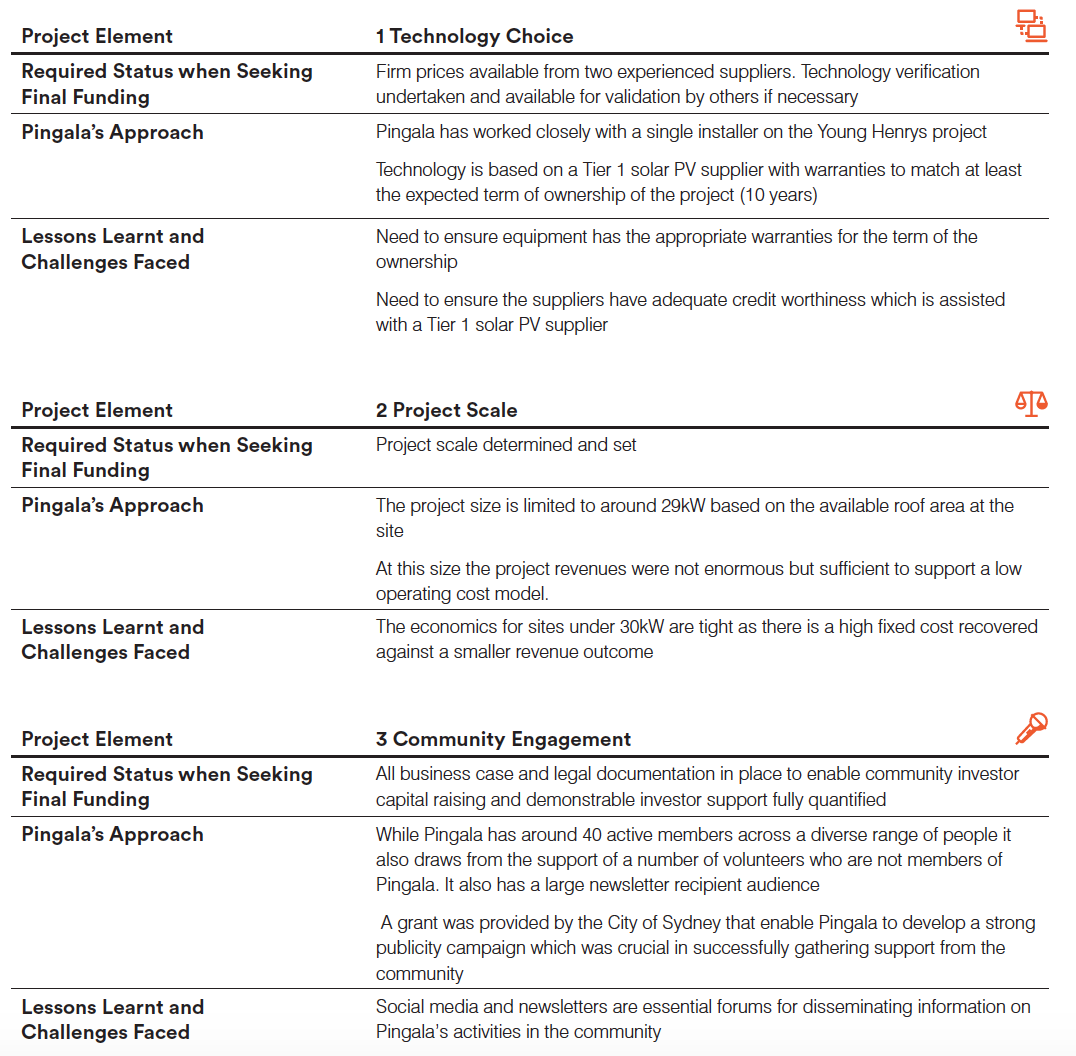

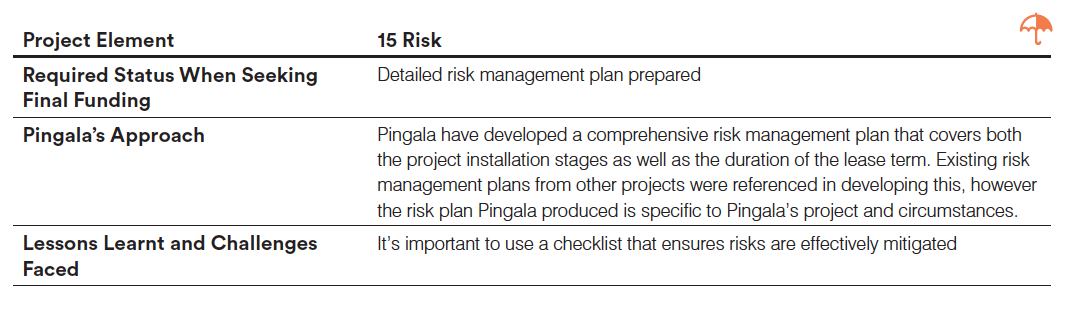

The table below sets out how Pingala has managed the 16 project elements set out in this Behind the Meter Guidebook together with the lessons they learnt and the challenges they faced along the way.

Downloads and links

Downloads and links

Check out the whole Behind the meter Toolkit or the Funding and Finance Toolkit.